Last updated on: 05 March 2025

-

Background:

Si Creva Capital Services Private Limited is a private limited company, incorporated under the provisions of the Companies Act, 2013, having Corporate Identification Number (CIN) U65923MH2015PTC266425 (“Si Creva” / “Company”). Si Creva is a Middle Layer Non- Deposit taking Non-Banking Financial Company (“NBFC”) as per the Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) Directions, 2023 (“Master Directions”), registered and regulated by the Reserve Bank of India (“RBI”) bearing Registration No. N-13.02129.

Si Creva is in the business of the provision of secured and unsecured consumer and personal and business loans by using two digital lending applications viz; ‘Kissht’ and ‘PaywithRing’ and OnEMI Technology Solutions Private Limited, a Lending Service Provider (LSP). Besides this, it is also lending through mobile app and web-based applications on the platforms of other LSPs including as a co-lender with other regulated entities.

-

Introduction:

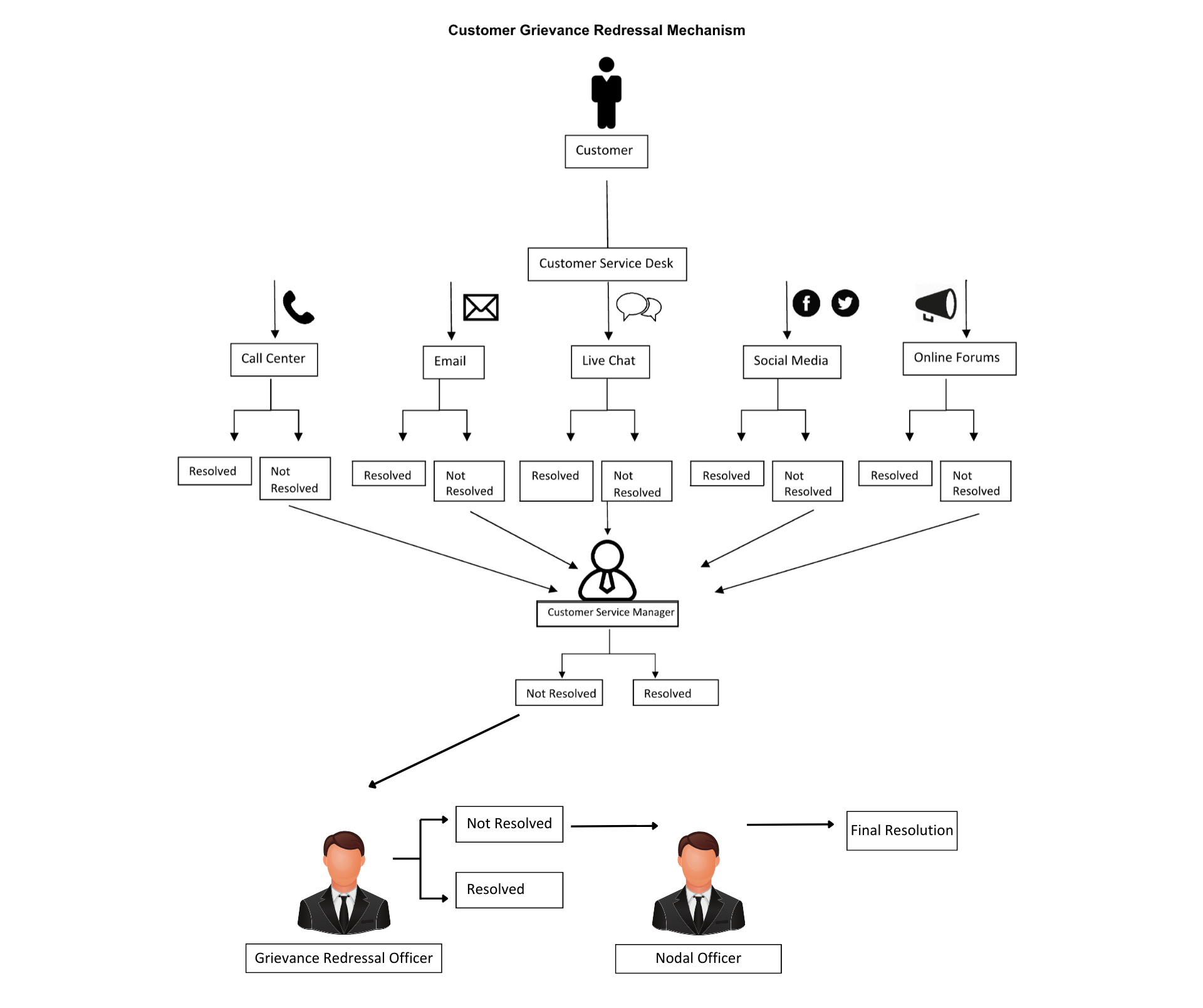

In accordance with Chapter VII of the Master Direction on Fair Practices Code, Si Creva has formulated this Policy, hereinafter referred to as “Customer Grievance Redressal Mechanism” (the “Policy”).

Our Grievance Redressal Mechanism is designed to ensure that all customer complaints and concerns are addressed promptly and effectively. We encourage our customers to raise grievances through designated channels, and we commit to resolving issues within a specified timeframe. Our dedicated grievance redressal team will investigate each complaint thoroughly and provide feedback to the complainant. We aim to foster transparency and trust, ensuring that our clients feel heard and valued in their interactions with us.

-

Applicability:

This Mechanism applies to all customers, stakeholders, and employees of the Company. It encompasses all services and products offered by the company customer. This Mechanism is intended for use in all customer interactions, including face-to-face communications, telephonic conversations, and electronic correspondences. Additionally, it applies to any third-party service providers engaged by the NBFC in delivering services to customers. All parties involved are encouraged to familiarize themselves with the Mechanism to ensure effective communication and resolution of grievances.

-

Objective:

The type of complaints received by the Company together with the objective of this policy are as follows:

Categories Blank Complaint CIBIL related including updation of data at the request of customer Collection related Complaint related to Other NBFC / Bank Disbursement related Insurance related IVR Calls/SMS related Product related EMI related Unable to Apply / Technical Issue Payments and Refunds - To ensure that a structured and robust internal mechanism for recording and resolving customer grievances is established.

- Customer grievances are resolved in a courteous and time-bound manner with a detailed response to the customer.

- To minimize customer dissatisfaction by identifying any shortcomings in service delivery and reporting the same to the concerned department so as to rectify the same at the earliest and repeat complaints of the same nature are avoided.

- To ensure that customers are always fully informed of various avenues available to escalate their grievances.

- To ensure that the Company and its employees treats all complaints efficiently and fairly as they can damage the Company’s reputation and business if handled otherwise.

- To ensure that customers of the Company are always treated fairly and without Bias. The customers do not face any inconvenience in dealing with it; and in cases where there have been any errors or commissions and omissions, the Company will address the same quickly and sympathetically.

- To follow the procedure for uploading of customer data on the portals of CICs and to take effective measures – (a) to appoint a nodal officer or nodal point/ official of contact for CICs for redressal of customer grievances and update the customers of the corrective action taken, (b) to inform the customers the reasons for the rejection of their request for data correction, if any.

- To honour the decision given by the Ombudsman.

- To ensure the issues relating to services provided by Outsourced Agencies are addressed and shall sensitize the respective outsourcing service providers to resolve/escalate customer issues expeditiously and within the Turn-Around-Time (“TAT”).

- To ensure that the customers are made completely aware of their rights so that they can opt for alternative remedies, if they are not fully satisfied with our response or resolution to their compliant.

-

Grievance Redressal Procedure for Touchpoints / Channels operated by the Company:

-

Call Centre

The Company shall publish customer care numbers on its website for customers to contact and register their complaints/queries. The customers can get in touch with the customer service executive over call between 9:30 a.m. to 6:30 p.m., 7 (seven) days a week & 365 (three sixty-five) days a year by dialing the number;

(i) Kissht Helpline: 022 62820570 / 022 48914921

(ii) Ring Helpline: 022 41434302 / 020 68135496

- As soon as the customer raises any complaint on-call (telephonically), the customer care executive shall capture the complaint online and forward it to the relevant backend unit or department for resolution. An acknowledgment will be sent to the customer’s registered e-mail address once the complaint has been recorded.

- The customer is provided with a turnaround time (“TAT”) for the resolution of the complaint (the TAT ranges from 1 (one) Business Day to 7 (seven) Business Days depending on the type of complaint received and the time required to resolve the same by the concerned department/backend unit). For the purpose of this Policy, Business Day(s) shall mean a day other than (i) non-working Saturdays and Sundays, (ii) a day on which banks/NBFCs in India and /or Reserve Bank of India (“RBI”) are closed for business.

- The customer shall be intimated about the resolution by e-mail or call. The delivery of intimation depends on whether the same was promised by the customer service executive while taking the complaint.

-

E-mail

The customer can e-mail their grievances/complaints to the Company’s customer service e-mail id care@kissht.com/ care@paywithring.com OR they can send an e-mail to the Company’s dedicated customer grievance e-mail id: escalation@kissht.com/ escalation@paywithring.com

- Within a minimum of one (1) hour and a maximum of twenty-four (24) hours from the submission of a complaint via e-mail, the customer care executive shall capture the complaint online and forward it to the relevant backend unit or department for resolution. An acknowledgment will be sent to the customer’s registered e-mail address once the complaint has been recorded.

- If an existing customer’s complaint is not received from the customer’s registered e-mail id, then a reply shall be sent asking for details related to the customer’s account like registered e-mail id or mobile number so as to fetch the customer’s account details and then assist him/her accordingly.

- The customer is provided with a TAT for resolution of the complaint (the TAT ranges from 1 (one) Business Day to 7 (seven) Business Days depending on the type of complaint received and the time required to resolve the same by the concerned department/backend unit).

- The customer shall be intimated about the resolution by e-mail or call. The delivery of intimation depends on the mode of communication, which may have been assured by the customer service executive while taking the complaint.

-

Live Chat

The Company provides live chat facility on its Mobile App, i.e. the Kissht/PaywithRing application, for customers to get in touch with customer service executives and register their complaints/queries.

- Within a minimum of one (1) hour and a maximum of twenty-four (24) hours from the submission of a complaint on chat, the customer care executive shall capture the complaint online and forward it to the relevant backend unit or department for resolution. An acknowledgment will be sent to the customer’s registered e-mail address once the complaint has been recorded.

- The customer is provided with a TAT for resolution of the complaint (the TAT ranges from 1 (one) Business Day to 7 (seven) Business Days depending on the type of complaint received and the time required to resolve the same by the concerned department/backend unit).

- The customer shall be intimated about the resolution by e-mail, call or live chat. The delivery of intimation depends on the mode of communication, which may have been assured by the customer service executive while taking the complaint.

Please see below the Live Chat Numbers:

-Kissht Livechat Number: 022 48913631

-PaywithRing Livechat Number: 022 41434380

-

Social Media

With the emergence of social media and increasing usage of the same across all age groups, the same has become an integral part of customer touchpoints available with companies. While social media is not considered the right channel to raise complaints, a lot of young customers may use it regularly to communicate with the Company. As a result, customers who raise their concerns on social media channels that are operated by the Company and which give the option to send a message or post a message (e.g. Facebook and Twitter) are replied to by the customer service team of the Company as under:

- Within a minimum of one (1) hour and a maximum of twenty-four (24) hours from the submission of a complaint on these channels, the customer care executive shall capture the complaint online and forward it to the relevant backend unit or department for resolution. As soon as the complaint is captured, an acknowledgment reply shall be sent to the customer over the same social media channel on which the complaint was raised OR on the customer’s registered e-mail id.

- If an existing customer’s complaint on social media is not accompanied by his/her registered account details then a reply shall be sent asking for details related to the customer’s account registered e-mail id or mobile number so as to fetch the customer’s account details and then assist him/her accordingly.

- The customer is provided with a TAT for resolution of the complaint (The TAT ranges from 1 (one) Business Day to 7 (seven) Business Days depending on the type of complaint received and the time required to resolve the same by the concerned department/backend unit).

- The customer shall be intimated about the resolution by e-mail, call, or reply over the same social media channel on which the complaint was raised. The delivery of intimation depends on the mode of communication, which may have been assured by the customer service executive while taking the complaint.

-

Branch Offices

The company operates multiple branch offices across India to support customers. Each branch office clearly displays contact details for the customer service team, available via call, chat, and email, to assist customers effectively. Additionally, each branch office provides the names of the designated Grievance Redressal Officer and Nodal Officer, whom customers can reach out to for any further assistance.

-

-

Grievance Redressal Procedure for Alternative Channels not operated by the Company:

-

Online Consumer Forum (operated by third parties and used by some consumers for sharing their issues or reviews)

There are many Online Consumer Forum that enable consumers from across all industries to communicate, raise complaints, ask queries, give suggestions, or write a review about a product, service, or experience that they have had in the past or present. While it is not possible for a Company to track all such forums on a daily basis, the customer service department of the Company shall do its best to cater to all complaints, queries, reviews, or suggestions raised on such forums provided that the forums have a facility in place whereby the company is intimated by the forum about such complaints, queries, reviews or suggestions raised by customers.

- For the resolution of any complaint/grievance submitted using third party Online Consumer Forum, it is necessary for the Company to receive an intimation over e-mail from such forum, as the company may not be aware of the existence of such forum or the complaints, queries, reviews or suggestions raised by customers on such forums.

- Online Consumer Forums can send an e-mail to the Company’s customer service e-mail id care@kissht.com/ care@paywithring.com OR even they can send an e-mail to the Company’s dedicated customer grievance e-mail id escalation@kissht.com/ escalation@paywithring.com so that the customer service desk of the Company is made aware about all complaints, queries, reviews or suggestions raised by customers on such forums, and an appropriate response is made available to the customer accordingly.

- Within a minimum of one (1) hour and a maximum of twenty-four (24) hours from the submission of a complaint on these channels, the customer care executive shall capture the complaint online and forward it to the relevant backend unit or department for resolution. As soon as the complaint is captured, an acknowledgment reply shall be sent to the customer over the same online forum on which the complaint was raised or on the customer’s registered e-mail id.

- If an existing customer’s complaint on any online forums is not accompanied by his/her registered account details, then a reply shall be sent asking for details related to the customer’s account like registered e-mail id, or mobile number so as to fetch the customer’s account details and then assist him/her accordingly.

- The customer is provided with a TAT for resolution of the complaint (the TAT ranges from 1 (one) Business Day to 7 (seven) Business Days depending on the type of complaint received and the time required to resolve the same by the concerned department/backend unit).

- The customer shall be intimated about the resolution by e-mail, call, or reply over the same online forum on which the complaint was raised. The delivery of intimation depends on the mode of communication, which may have been assured by the customer service executive while taking the complaint.

-

-

Grievance Redressal for Persons with Disabilities:

We have established an accessible and user-friendly online portal designed to accommodate all customers, including persons with disabilities. This portal enables customers to file grievances conveniently, without needing to visit a branch office or directly contact our customer service team via call, chat, or email. By simply visiting the portal at https://sicrevacapital.com/raise-query-request-complaint/, customers can easily submit their queries, requests, or complaints. Our dedicated team reviews each submission promptly to provide a suitable resolution. The portal operates 24/7, allowing customers to file grievances at their convenience. We are committed to making our services accessible and inclusive for everyone.

-

Grievance Redressal for handling complaints against lending partners:

It shall be the responsibility of the Company to explain and disclose to the end borrowers regarding the difference between products offered through the co-lending model as compared to its own products. The front-ending lender will be primarily responsible for providing the required customer service and grievance redressal to the borrower. With regard to grievance redressal, any complaint registered by a borrower with the NBFC/ Lender shall also be shared with other Lender/ NBFC so as to enable the other partner to examine the complaint as per their FPC / Customer Grievance Redressal policy; in case the complaint is not resolved within 30 days, the borrower would have the option to escalate the same with the concerned Lender’s Ombudsman/ RBI’s Ombudsman for NBFCs.

-

Escalation Process

-

Level 1:

All complaints/grievances received from various channels are catered to by the customer service desk as per the above-mentioned Grievance Redressal procedure. If the complaint is not resolved within the given TAT, the same will be escalated by the customer service desk via official e-mail to the customer service manager of the Company (“Customer Service Manager”).

In addition to this, the customer can also request the customer service desk (by using touch points like call, e-mail, or Live Chat) to arrange a callback directly from the Customer Service Manager of the Company for escalating his/her issue. Within a minimum of 1 (one) hour to a maximum of 24 (twenty-four) hours of receipt of such request/escalation, the Customer Service Manager of the Company shall himself/herself call the respective customer and speak to him/her in order to provide a final resolution or further resolution timeline on the complaint/grievance. In cases where the Customer Service Manager of the Company needs to co-ordinate with a particular department for resolving a complaint, he/she needs to inform the customer that he/she will get back to the customer with a final resolution or further resolution timeline in not more than 2 (two) Business Days.

Note: If there is no response/resolution given by the Customer Service Manager of the Company within the above TAT, then the customer service desk shall escalate the case to the Grievance Redressal Officer via official e-mail for taking necessary action.

-

Level 2:

If the customer is not satisfied with the response/resolution given by the Customer Service Manager of the Company or in case the grievance is not redressed within a period of one month from the date of its first submission, he/she can write directly to the Grievance Redressal Officer of the Company at the below-mentioned contact details:

Mukul Dwivedi

Si Creva Capital Services Private Limited,

10th Floor, Tower 4, Equinox Park, LBS Marg, Kurla West,

Mumbai, Maharashtra 400070.

E-mail Id: mukul.dwivedi@sicrevacapital.com

Contact No: 08044745954

In E-mail, kindly also mark CC to: info@sicrevacapital.com -

Level 3

If the customer is not satisfied with the response/resolution given by the Grievance Redressal Officer of the Company or in case the grievance is not redressed within a period of one month from the date of its first submission, he/she can write directly to the Nodal Officer of the Company at the below-mentioned contact details:

Benishba Jivin

Si Creva Capital Services Private Limited,

10th Floor, Tower 4, Equinox Park, LBS Marg, Kurla West,

Mumbai, Maharashtra 400070.

E-mail Id: benishba.jivin@sicrevacapital.com

Contact No: 08044745953

In E-mail, kindly also mark CC to: info@sicrevacapital.com. -

Level 4

If the customer is not satisfied with the response/resolution given by the Nodal Officer or in case the grievance is not redressed within a period of one month from the date of its first submission, then he can write to:

Officer-in-Charge

Reserve Bank of India,

Department of Non-Banking Supervision,

3rd Floor, RBI Building,

Opp. Mumbai Central Railway Station,

Near Maratha Mandir, Byculla,

Mumbai – 400 008Complaints can also be filed, in the prescribed format (available on the RBI website –

https://cms.rbi.org.in or https://sachet.rbi.org.in/), or sent in physical mode to

The Centralised Receipt and Processing Centre

Reserve Bank of India,

4th Floor,

Sector 17,

Chandigarh – 160017A copy of the Reserve Bank -Integrated Ombudsman Scheme, 2021 is available on the RBI website and on the CMS portal (https://cms.rbi.org.in).

At all the branches/head office and website of Si Creva, a notice has been put up informing the customers about the escalation mechanism and the Grievance Redressal Officer (including the name and contact details).

-

-

Sensitizing customer service staff for handling complaints

- All staff involved in customer service must receive comprehensive training to effectively handle complaints and escalations. Customer service inherently involves interacting with people, each of whom brings their own emotions, self-respect, egos, and personal stresses to the table. As a result, disagreements or differing opinions are inevitable. Therefore, it is crucial that customer service employees approach every interaction with an open mind and a positive attitude, maintaining a friendly demeanor to build trust and confidence with customers. In recognition of this, the Company has implemented robust systems and protocols to ensure the highest level of customer satisfaction.

- Providing training on the process as well as soft skills is very much required for handling irate customers and hence it should be an integral part of the employee training program for customer service executives ^ managers. The Head of Customer Service needs to ensure that the Grievance Redressal Mechanism operates efficiently and smoothly across all levels.

- In order to assess the efficacy of the mechanism in addressing the customers’ grievances and validating that the products and processes of the Company are widely accepted, the Company will conduct audit of the quality of customer service across all levels and channels, so as to ensure that best quality of customer service as per accepted standard is maintained regularly.

-

Internal Review Mechanism:

- All customer complaints or grievances will be updated in the internal Customer Relationship Management (“CRM”) software and tracked until closure as per the process.

- Management will periodically review the customer grievance tracker to ensure timely response/closure of customer complaints.

-

Exclusions:

The following complaints/allegations shall not be taken up for consideration and disposal as ‘Customer Complaint’:

- Anonymous complaints without proper supporting details;

- Matters involving decisions in which the complainant has not been affected either directly or indirectly;

- Matters that are sub-judice or where any judicial authority had passed an order;

- Cases which have been reported as fraud and/or is under investigation by government authority like Police, Tax, etc. or where the authority has already taken a view on the subject matter, after investigation;

- A fresh complaint, which is already under consideration of the Ombudsman/Appellate Authority appointed under Ombudsman Scheme for Non-Banking Financial Companies, 2018.

-

Categorization of Customer Interactions

Customer interactions are categorized into the following buckets/categories:

- Complaints: These interactions involve customers expressing dissatisfaction or grievances about a product, service, or experience. Complaints can range from minor issues to more significant problems that require resolution.

- Queries: Queries are customer interactions where individuals seek information or clarification about a product, service, policy, or any other aspect related to a business. These inquiries can be general or specific in nature.

- Requests: Requests involve customers requesting a specific action or service from a company. This could include things like scheduling a service appointment, requesting a loan related document, making changes to an account, etc.

These categories enable us to effectively manage and prioritize customer interactions, ensuring that each request or issue is addressed in a timely and appropriate manner. Additionally, the company has established a detailed Standard Operating Procedure (SOP) along with a clearly defined Turnaround Time (TAT).

-

Root Cause Analysis:

A comprehensive root cause analysis is performed quarterly to identify process gaps and lapses. Insights from this analysis are shared with relevant teams, enabling corrective actions that enhance service quality and reduce recurring issues. This systematic approach, led by a dedicated customer grievance committee, plays a vital role in maintaining customer satisfaction and continuously improving service standards. Following is the manner in which such analyses are carried out through a dedicated customer grievance committee:

-

Establish a Customer Grievance Committee:

- We have formed a dedicated team comprising representatives from various departments, including customer support, product development, quality control, and management.

- We have appointed a chairperson responsible for overseeing the analysis process.

- A comprehensive report on customer grievances shall be reviewed and discussed in the meeting.

-

Collect and Document Complaints:

- We gather all customer complaints received during the quarter. These may come from various channels such as emails, live chat, phone calls and social media.

- To ensure we are able to gather complaints efficiently, we maintain a well-organized CRM database for recording and tracking complaints.

-

Categorize and Prioritize Complaints:

- We then group complaints into categories such as product defects, service issues, communication problems, or other relevant classifications.

- Complaints are also prioritized based on severity, frequency, and customer type.

-

Root Cause Analysis:

- For each complaint category, conduct a root cause analysis to identify and resolve the underlying reasons for the grievances;

- We also involve relevant department heads/functional experts in the analysis process to gain diverse perspectives.

-

Identify Actionable Solutions:

- Once the root causes are identified, the Customer Grievance Committee members brainstorm and propose actionable solutions to address these issues.

- The focus her is on long-term solutions that prevent the recurrence of similar complaints in the future and also on how to reduce the TAT of complaint resolution.

-

Monitor Progress:

- Implement the proposed solutions and monitor their effectiveness over time.

-

Continuous Feedback Loop:

- Encourage open communication channels within the committee and with other departments.

- Continuously gather feedback from customer service representatives and frontline staff who interact with customers directly.

-

Reporting to Audit Committee / Board:

The outcome of RCA shall be placed before the Board at periodical intervals for their review and guidance of further measures required, if any.

-

Train and Empower Staff:

- Share the RCA findings with the staff with the departments of customer support, product development, quality control, and management (comprising the Customer Grievance Committee) wherever required with an aim that the causative factors of the complaints should be reduced, if not entirely eradicated;

- Provide training to employees to help them understand the importance of resolving customer grievances promptly and effectively.

- Equip customer service teams with the necessary tools and resources to improve TAT.

By following this process every quarter, our customer grievance committee is able to proactively identify and address the root causes of complaints, leading to a reduction in grievances and improved customer satisfaction. Additionally, the focus on reducing TAT for complaint resolution ensures that customers receive timely responses and resolutions, enhancing their overall experience with your organization.

-

-

Display of Grievance Redressal Mechanism (“GRM”):

For the benefits of the customers, the Company has displayed the GRM prominently, in all the office premises of the Company. The customers can also access the GRM on the website of the Company.

-

Policy Revision

This Mechanism will be reviewed at yearly intervals or as and when considered necessary by the Audit Committee and thereafter be approved by the Board of Directors of the Company, and will be revised based on extant regulatory guidelines from time to time.

-

Customer Callback Timings for Grievance Redressal:

Our company places utmost importance on effective communication with our customers to guarantee their satisfaction. In line with our dedication to delivering exceptional customer service, our Customer Service Team operates within specified callback hours from 8:00 am to 7:00 pm every day. Within this timeframe, we are committed to promptly updating customers on the status of their queries, requests, and complaints.

However, certain circumstances may arise where extending our callback hours becomes necessary to resolve the issue expeditiously and on specific consent/request by the customer. In such instances, the team will obtain prior written approval over an official email/chat from the customer to make calls before 8:00 am or after 7:00 pm concerning the resolution of their grievance. This approval will solely be utilized for discussing grievance resolution and no other purpose whatsoever. Such calls will not be initiated unless written approval is received.

-

Review of the Policy

The Policy will be reviewed at yearly intervals or as and when considered necessary by the Nomination and Remuneration Committee and thereafter be approved by the Board of Directors of the Company and will be revised based on extant regulatory guidelines from time to time.

-

Omnibus Clause:

All extant & future master circular/directions/guidance/guidance notes issued by RBI and other regulators from time to time would be the directing force and will super cede the contents of this policy.

For Si Creva Capital Services Private Limited